How to Prepare for Purchasing Your Dream Vacation Home on 30A in a Buyer's Market

As seasoned market specialists along 30A and South Walton, we've witnessed the ebb and flow of real estate trends over the years. Through every market cycle, we've been right beside our clients, guiding them through the complexities of buying and selling, and helping them achieve their real estate goals. That commitment to our clients remains as strong as ever, especially in today’s evolving market.

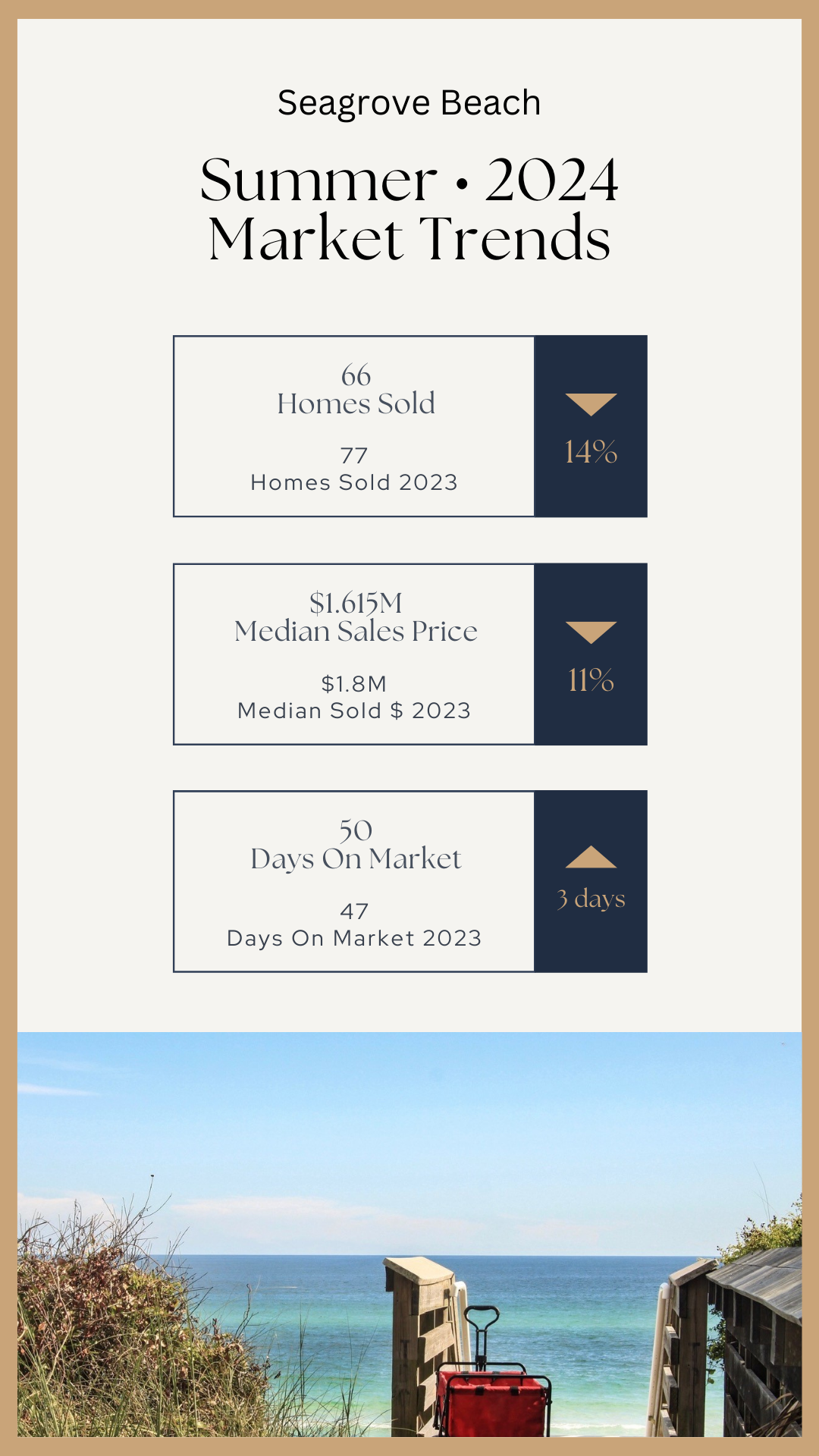

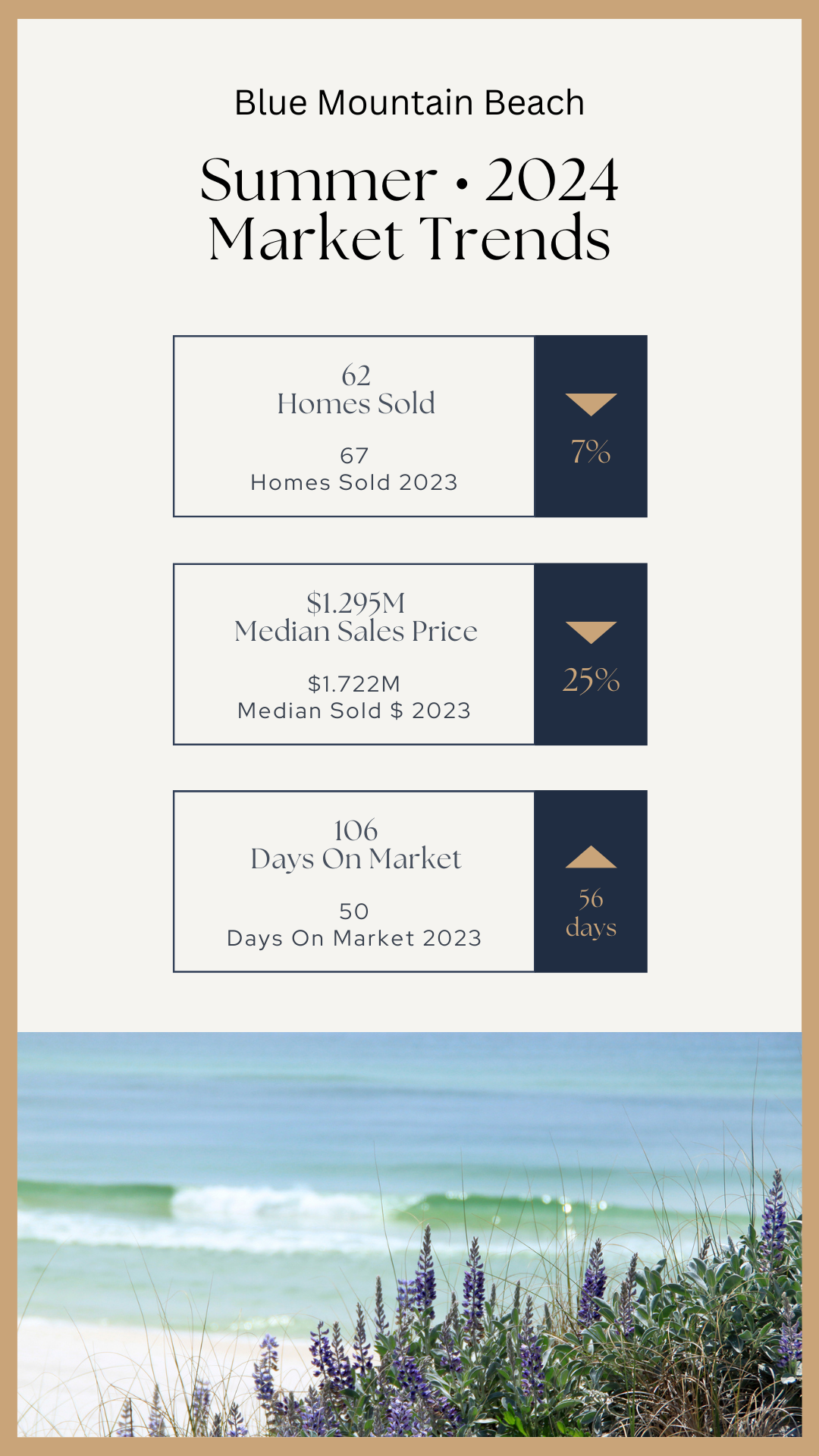

Right now, we're experiencing a shift towards a buyer’s market along 30A. As we reported in the first quarter, prices continue to fluctuate in certain communities. Here’s an example of what’s happening in the Top 3 Communities for sales along 30A:

The changing market brings new opportunities for those looking to purchase a vacation home or investment property. But just because the market favors buyers doesn’t mean you can afford to be unprepared. Success still hinges on strategy, timing, and a clear understanding of your goals. Here's what you need to know:

Understand the Current Market Dynamics

In a buyer’s market, inventory is typically higher, and properties may linger on the market longer. This creates opportunities for you to negotiate more favorable terms, but it’s essential to have a solid grasp of what’s happening in the market.

For instance, while there may be more homes available, not all of them may meet your specific needs. The key is to stay informed. We’re seeing increased inventory along 30A, but also variability in pricing depending on the location and property type. Knowing which areas are seeing price reductions or where there’s less competition can help you make a more strategic purchase.

Get Your Finances in Order

Even in a buyer’s market, being financially prepared is crucial. With more properties to choose from, you might find yourself tempted to jump on a deal before you’re fully prepared. Avoid this by:

- Assessing Your Budget: Determine your budget based on a thorough understanding of your finances. Include all potential costs, such as mortgage payments, property taxes, insurance, and maintenance.

- Securing Financing: If you plan to finance your purchase, get pre-approved by a local lender. Local lenders understand the nuances of the 30A market and can help you navigate the process smoothly. They’re also more familiar with local property values, which can prevent potential appraisal issues that sometimes occur with out-of-area lenders.

Identify Your Long-Term Goals

Buying a vacation home or investment property is a significant commitment. Clarify your long-term goals before diving into the market:

- Primary Residence vs. Investment: Are you buying a property to use primarily as a vacation home, or is your goal to generate rental income? The answer will influence everything from the type of property you buy to its location.

- Rental Potential: If rental income is a priority, focus on properties in areas with high rental demand. Consider the seasonality of the rental market and what features make a property attractive to renters.

Familiarize Yourself with the Local Market

The 30A area is diverse, with each community offering something unique. From the quaint streets of Seaside, FL, to the upscale ambiance of Rosemary Beach, FL, the right location is key to meeting your needs. Here’s how to zero in on the best fit:

- Explore the Communities: Take the time to explore the different communities along 30A. Each neighborhood has its own character, amenities, and vibe. Whether you're looking for a quiet retreat or a bustling rental hotspot, there’s a perfect place for you.

- Consult Market Reports: We can provide you with up-to-date market reports that offer insights into price trends, average days on the market, and which areas are seeing the most activity. This information can help you target your search more effectively.

Be Ready to Act When the Time Is Right

While a buyer’s market gives you more leverage, the best properties still move quickly. Once you’ve done your homework, secured your financing, and identified your target areas, be ready to act:

- Make Competitive Offers: Even in a buyer’s market, well-priced, desirable properties can attract multiple offers. Be prepared to make a strong offer when you find the right property.

- Negotiate Smartly: With more room for negotiation, consider asking for concessions such as closing cost assistance or repairs. But keep in mind that flexibility and good communication can also be key to securing a deal that works for both parties.

Purchasing a vacation home or investment property along 30A in today’s buyer’s market can be a rewarding endeavor if you’re well-prepared. By understanding the market, getting your finances in order, and clarifying your goals, you’ll be ready to take advantage of the opportunities that this market presents.

Our team is here to help you navigate every step of the process. Whether you have questions about specific neighborhoods, market trends, or financing options, we’re ready to provide the guidance and support you need. Reach out to us today—no question is too small, and we’re here to help you turn your 30A real estate dreams into reality.

* The real estate market data provided is taken from Emerald Coast Assoc. of Realtor's MLS. While we believe this information to be reliable, we cannot guarantee its accuracy.

Posted by Robin Maynard on

Leave A Comment