Living along 30A means embracing the beauty of the Gulf while also preparing for the realities of storm season. Homeowners in Walton County can take advantage of insurance discounts that help lower premiums, but it's important to understand the difference between flood insurance discounts and windstorm mitigation discounts.

Both offer savings, but they apply to different types of risks. Let's break down how each works and how you can benefit from these programs.

Flood Insurance Discounts: Protecting Against Rising Water

What it covers: Flood insurance covers damage caused by storm surges, heavy rain, overflowing water bodies, and other forms of flooding. Homeowners insurance does NOT cover flood damage, so a separate policy is required.

Who Offers It?

Flood insurance is available through FEMA's National Flood Insurance Program (NFIP) and private insurers.

How to Get a Flood Insurance Discount

Community Rating System (CRS) Discounts

- Walton County participates in FEMA's CRS program, which rewards communities that take steps to reduce flood risk.

- Depending on the community's CRS score, homeowners can get up to 45% off their flood insurance premiums.

Home Elevation

- Homes built above the Base Flood Elevation (BFE) set by FEMA receive lower premiums.

- Elevating an existing home may qualify you for additional savings.

Flood Mitigation Features

- Installing flood vents, sump pumps, or elevated electrical systems can help lower costs.

Location in a Flood Zone

- Homes outside high-risk flood zones (AE, VE) naturally have lower flood insurance premiums.

Takeaway: If your property is near the Gulf, Choctawhatchee Bay, or a flood-prone area, checking your community's CRS rating and making flood-resistant upgrades can help lower costs.

Wind and Storm Mitigation Discounts: Protecting Against Hurricane Winds

What it covers: Wind mitigation discounts apply to homeowners insurance policies, reducing premiums for homes better equipped to withstand hurricanes and severe storms.

Who Offers It? Private home insurance companies, regulated by the Florida Office of Insurance Regulation, offer discounts for homes with storm-resistant features.

How to Get a Wind Mitigation Discount

Wind Mitigation Inspection (Required for Discounts)

- Homeowners must get a certified Wind Mitigation Inspection to qualify for savings.

- The report determines if your home meets Florida's wind-resistant construction standards.

Qualifying Wind Mitigation Features

- Hurricane Shutters or Impact-Resistant Windows – Protects against flying debris.

- Roof Reinforcements (Hurricane Straps, Clips, or Tie-Downs) – Strengthen the connection between the roof and walls.

- Secondary Water Barriers – Prevents water from entering if roof shingles blow off.

- Reinforced Garage Doors – Helps prevent structural failure during high winds.

Florida Building Code Compliance

- Homes built after 2002 (when Florida's stricter building codes took effect) automatically qualify for discounts.

How Much Can You Save?

- Wind mitigation discounts can reduce homeowners insurance premiums by up to 20%.

- The more storm-resistant features your home has, the greater the savings.

Takeaway: If you live in Walton County, especially along 30A, wind mitigation upgrades can significantly save your homeowner's insurance while protecting your home from hurricane damage.

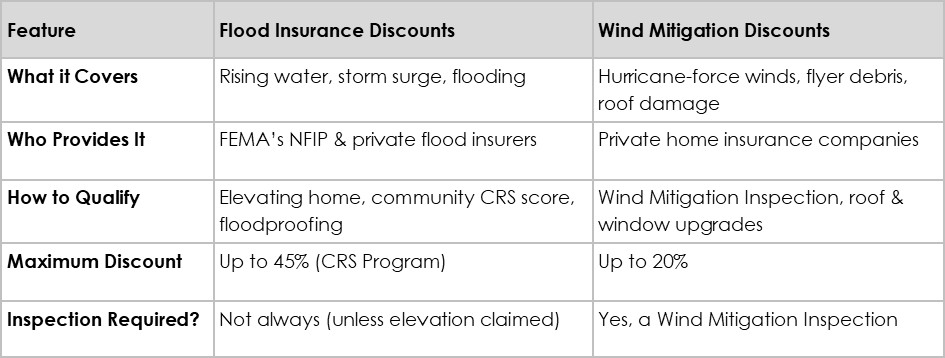

Flood vs. Wind Discounts: What's the Difference?

Which Insurance Discount Should You Prioritize?

If you live in a high-risk flood zone (AE, VE), focus on:

✅ Community Rating System (CRS) discounts

✅ Elevating your home

✅ Installing flood mitigation features

If you're in a hurricane-prone area like 30A, prioritize:

✅ Wind mitigation features like shutters and impact-resistant windows

✅ A Wind Mitigation Inspection

✅ Roof reinforcements and hurricane straps

Maximize Your Savings & Protection

Unincorporated communities in Walton County, including Seaside, Rosemary Beach, WaterColor, and Grayton Beach, are participants in the CRS program, but some incorporated towns may also qualify. It's important to verify your community's status.

What to do next:

✅ Check if your area participates in the CRS program to take advantage of flood insurance savings.

✅ Schedule a Wind Mitigation Inspection to determine potential discounts on your homeowners insurance.

✅ Strengthen your home's storm defenses with upgrades like impact-resistant windows and reinforced roofing to enhance protection and maximize insurance savings.

By taking advantage of these programs, you can save thousands on insurance while ensuring your home is prepared for Florida's extreme weather.